Singaporeans on a whole are a whiny lot. Grievances can be heard from all walks of life and it never seen to be our own fault, someone has to be blamed for our plight. Well, here’s a realistic check – the whole world does not owe you a living and spending your free time on time traps such as mobile games, apps, social media etc are not going to get you anywhere. Budget 2015 has just been announced with some pretty good perks, it’s time to stop complain, take charge of your own life and milk the maximum benefits from Budget 2015!

1. Enhance Your Competitiveness!

Young PMEs, do you feel that you lack enough experience and skills to be taken seriously during job interviews or in your current job?

Hearing this feedback, NTUC’s Assistant Secretary-General (ASG) Patrick Tay mooted the idea of an individual training fund to the government earlier this year.

The SkillsFuture Account, recently announced in the Budget, will give all Singaporeans aged 25 and above an initial credit of $500. This fund will be topped up at regular intervals and will not expire.

Workers may tap on their SkillsFuture Account to pay for the portions of training costs that are unfunded by their employers, as well as fund Continuing Education and Training programmes. Now PMEs who do not have access to the Workfare Training Support (WTS) scheme get more help to upgrade themselves.

NTUC’s Deputy Secretary-General (DSG) Heng Chee How pointed out how Singapore should have ageless jobs and evergreen workers.

Mature PMEs above 40 years of age worry about losing their jobs and workplace age discrimination. If they do not have second skills and cannot find a job in the same industry, they will need to learn a new skill in another area to find a job.

As they also have more financial obligations, they will receive more education and training subsidies to a MINIMUM 90% of training costs for courses funded by the Ministry of Education and the Workforce Development Agency (WDA).

Deputy Prime Minister and Finance Minister Tharman Shanmugaratnam explained that these subsidies are significant. He quoted the example of a part-time undergraduate course such as a Bachelor of Engineering, the total fees payable by the student will be reduced by 60%, from about $17,000 to $6,800.

Skills Future Study Awards and SkillsFuture Fellowships will also be introduced to develop deep skills and mastery in the growth clusters of the future, as well as the SkillsFuture Leadership Development initiative to encourage companies to groom Singaporeans in leadership roles.

You can now choose to go for a short course using the $500 or accumulate credits for more substantial training in the future. Start by checking out some of the skills upgrading courses at WDA.

2. Master Your Second Skill

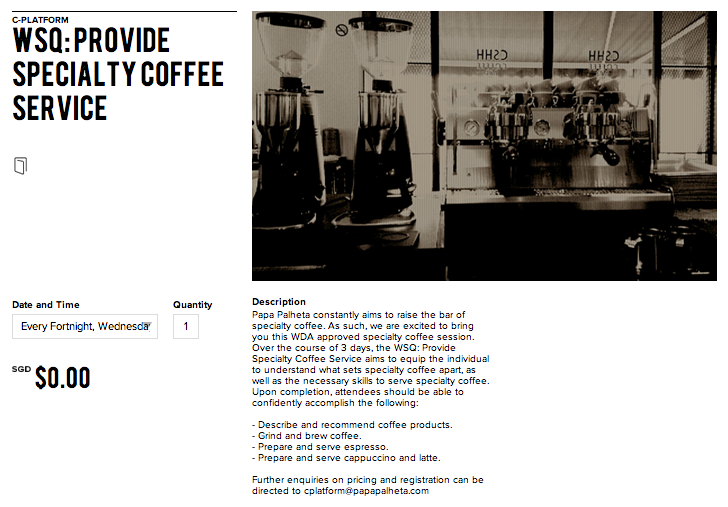

Alternatively, you can also use the SkillsFuture Credit to learn a Second Skill that you are passionate about.

According to a 2013 GfK survey, 43% of Singaporeans are worried about recession and unemployment, which are the second highest concerns after inflation. Middle-skilled jobs are also predicted to be at risk of vanishing in the future, and where will that leave Singaporean workers whose whole lives have been spent honing and perfecting one skill? Don’t you worry that you’ll be retrenched during the next economic / financial crisis or replaced by a younger / faster worker? Shouldn’t you be on the lookout for new ways to secure your personal career and livelihood in Singapore with second-skilling?

NTUC is aggressively pushing for employers and government to support second-skilling, which is about learning an alternate skill, even if it’s unrelated to your current job. The aim is to ensure all workers are well-prepared for an alternative career should our current jobs or skills become obsolete.

PMEs should explore WDA’s WSQ Courses For Individuals for some ideas.

3. Cut In Maid’s Levy

Starting 1st May 2015, all Singaporean households that are eligible for the Foreign Domestic Worker Levy Concession will enjoy a further discount on the monthly levy. Employers of foreign maids now pay $265 a month in levies, or $120 if they qualify for a concessionary rate. The concessionary rate will be cut to a mere $60. The concessionary levy will also be extended to families with children aged below 16 years, up from below 12 years old.

This means cost savings for the entire family and with the maid helping out with family and housework, it translate to more time and attention towards skills upgrading.

4. Greater Funds In CPF

The income ceiling for CPF contributions will be raised from $5,000 to $6,000 from next year onwards. This will allow middle-income Singaporeans to accumulate more CPF savings during their working years and the amount is very substantial.

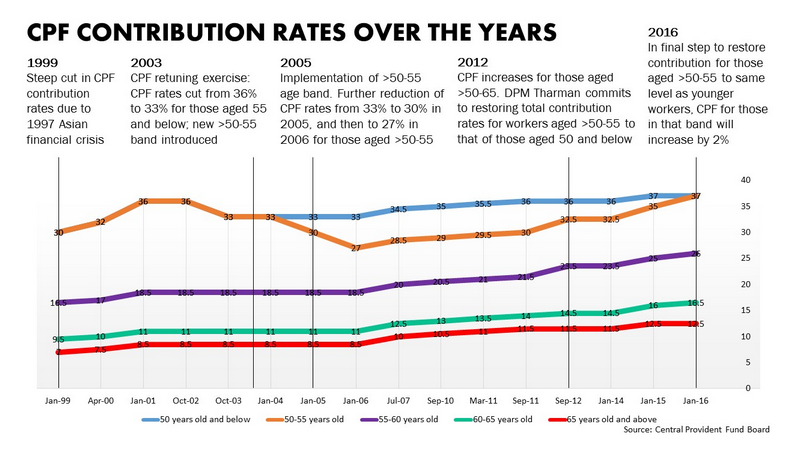

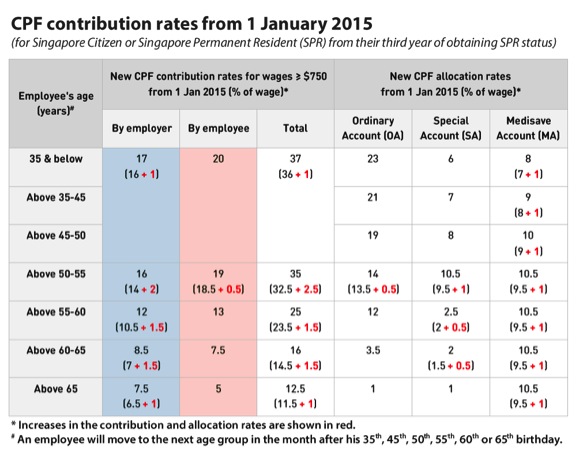

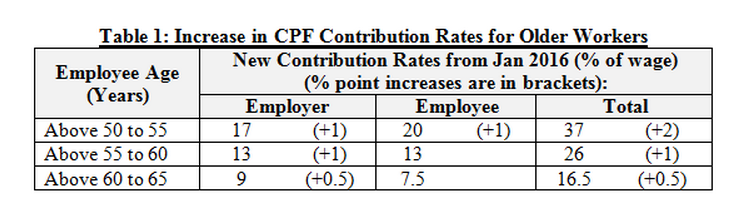

Heeding calls by NTUC Deputy Secretary-General (DSG), Heng Chee How for retirement adequacy – the relationship between available funds and the level of expenditure for a chosen standard of living and ways of enhancing it, our Government has raise the CPF contribution rate for older workers. CPF contribution rates will be restored for workers aged above 50 to 55 to the same level as those for younger workers. Specifically, the contribution rates for these workers will go up by two percentage points in 2016 – 1 per cent from the employer, and 1 per cent from the employee, bringing the total CPF contribution rate to 37 per cent.

To help mature Singaporeans grow their retirement funds, an additional 1 per cent interest will be applied to the first $30,000 of CPF savings for those aged 55 and above next year, on top of the existing 1 per cent extra interest on the first $60,000 of savings. This means that the first $30,000 in Special, Retirement or Medisave accounts can earn up to 6 per cent interest.

For the PMEs crowd, this will translate to more funds for stocks or property investments using CPF. Its time to arrange for a more property viewings and discussion with your bankers.

CPF contribution rates will be restored for workers aged above 50 to 55 to the same level as those for younger workers.

To help mature Singaporeans grow their retirement funds, an additional 1% interest will be applied to the first $30,000 of CPF savings for those aged 55 and above next year, on top of the existing 1% extra interest on the first $60,000 of savings. This means that the first $30,000 in Special, Retirement or Medisave accounts can earn up to 6% risk-free interest.

For the PMEs crowd, this will translate to more funds for stocks or property investments using CPF. It’s time to arrange for a more property viewings and discussion with your bankers.

Or if you’re not investment-savvy, 6% risk-free is a good deal as it’s comparable with the return of moderate risk investments such as REITs and unit trusts.

5. Tax Savings For Retirement Funds Growth

Singaporeans as a whole will be enjoying the following tax savings:

– 1.4 million Singaporeans will get an additional $50 in Goods and Services Tax (GST) Vouchers from this year. The increase in GST Voucher quantum across the board means that eligible individuals will receive up to $300 in cash.

– 1.5 million Singaporeans taxpayers will also enjoy a one-off tax rebate of 50 per cent, capped at $1,000, for the year of assessment (YA) 2015 for income earned in 2014.

– Drivers will enjoy a one-year road tax rebate of 20 per cent for cars, 60 per cent for motorcycles and 100 per cent for the small number of commercial vehicles using petrol.

Please resist the temptation to spend these cost savings on luxury products or services and channel them to grow your personal retirement funds.

6. Adapt & Save!

Petrol duty rates, which have plateaued since 2003 will go up with immediate effect. Duty rates for premium grade petrol will be increased by $0.20 per litre, and intermediate grade petrol by $0.15 per litre.

So ask yourself if you really need to drive. If not, give up this unnecessary luxury, take our efficient public transport and adopt a greener lifestyle.

There are opportunities to be reaped in every change and Budget 2015 has offered Singaporeans PMEs the chance to upgrade their skills, develop their second skills and prepare for retirement funds through increased CPF contributions and tax savings.

Our government has heeded our call, are you willing to take on the challenge?