It is not easy to eke a living in Singapore. Besides constantly upgrading our skills to fend off strong competition from foreign talents streaming in from all over the world, we also have to keep our eyes peeled on the raising standards of living. The situation is made worse by many Singaporeans who are ‘Moonlight Clan’ aka ‘月光族’ – folks who use up their entire salary before the end of each month. Things are not going to be forever rosy so better study up on insurances in Singapore before you get screwed by many of the unexpected health costs in life.

Protect Your Savings

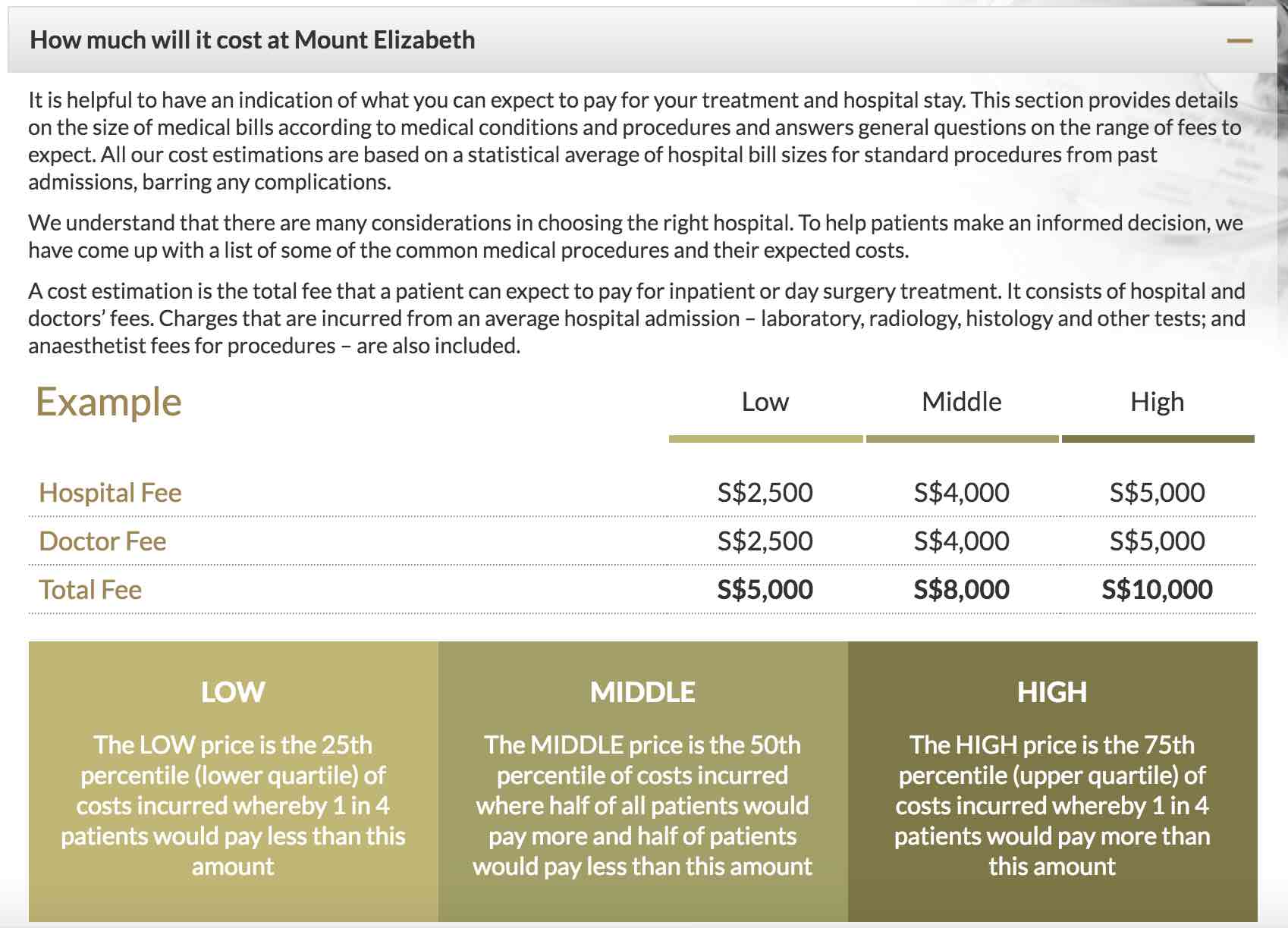

Some folks have their priorities right. They start to save for rainy days. But given the high cost of hospitalisation in Singapore, your savings may be wiped out within months and even weeks should life decides to screw you over. Let’s use the medical cost at Mount Elizabeth as an example:

Why allow your lifelong savings to go down the drain? It’s time to put in our defences in place for these nasty surprises life throw at us.

1. Let MediShield Life Take The First Hit!

Since 1st November 2015, Singaporeans and PR enjoy the protection of MediShield Life, a national savings scheme which helps CPF members save for future medical expenses, especially after retirement. Compared to the old MediShield, it has better protection for life, higher payout and can be used at all public healthcare institutions, and approved private hospitals and medical institutions.

MediShield Life is prepared to take on Class B2/C ward stays. But when it comes to critical illness, do you really want to limit you or your loved ones’ survivability? To obtain enhanced treatment in Class A / B1 wards in public or private hospitals, you should consider buying an Integrated Shield Plan (IP) from private insurers.

You cannot take money out from your Medisave account anyway. Why not use it to protect yourself adequately and enjoy the best treatment?

2. Make it ‘As Charged’

As much as we empathise with patients with chronic illnesses such as kidney failure where they have to pay hefty monthly fees for treatment, we wonder why they did not pay a small top up to their Integrated Shield Plan to make it ‘As Charged’.

‘As Charged’ means whatever cost that the hospital or treatment dumps to you, you send them direct to your insurer who will pay every single cent.

Damn, we love this.

Get Paid When You Are Down

1. Give Me The Money

Critical illness insurance pays a lump sum either when you are first diagnosed with a critical illness covered by the policy, or after having a type of surgery covered by the policy. The beauty of it is that the lump sum does not depend on your admission into hospital or on your actual medical expenses.

Yes, we know that with ‘As charged’, you no longer need to pay a single cent but it still pays to get hard cash on your hands. This critical illness benefit can be sold as a stand-alone plan or policy or be packaged into a life policy or as an optional rider to a life policy.

2. Provide Your Daily Dough

The disability income insurance is quite a beauty. It actually pays you a fixed amount each month to replace the income you would lose if you are unable to work as a result of an accident or illness. These policies may pay up to 80% of your average monthly salary.

If you are earning $5,000 as a Marketing Manager and you lost your sight due to an accident, this policy will kick in to pay you $4,000 a month for the rest of your life. It aims to ease your financial loss, but will not completely replace the income you earned before the accident or illness.

3. Get Paid While On Hospital Staycation

Hospital cash insurance pays a fixed amount of money for each day you are hospitalised for medical treatment or surgery. The total amount paid under this policy may be more or less than your actual medical expenses.

If you are already on ‘As charged’, just stay and collect the money.

With the above protections in place, you should be able to effectively rebut the saying that ‘In Singapore, you can die but you cannot get sick’. Be smart, navigate the loopholes and you and your loved ones can at least alleviate the financial pains during illness.

Email Us

Our trusted partners are MAS licensed financial advisory firms carefully selected to provide you a range of financial services. Their representatives will be assisting you regarding any insurance related advice or purchase. For customised financial advices, please email us